Halfords principally operates in two broad markets: Motoring and Cycling. Around 70% of Group sales are generated from products that are principally Motoring related with the remaining 30% coming from Cycling. At a profit level, the contribution of Motoring is even greater.

The Motoring Market

Category split of Halfords Group revenue

Motoring 70%

Cycling 30%

Retail as % of Halfords revenue

Retail 85%

Autocenters 15%

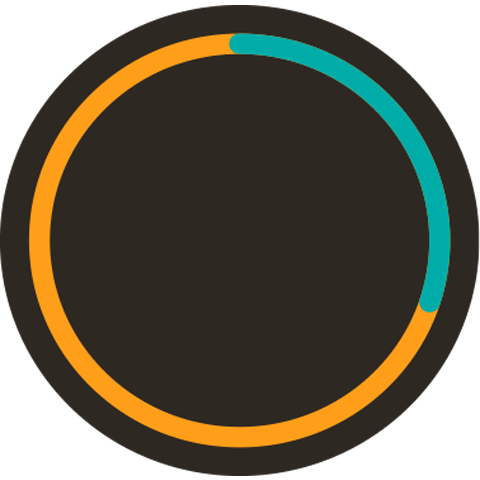

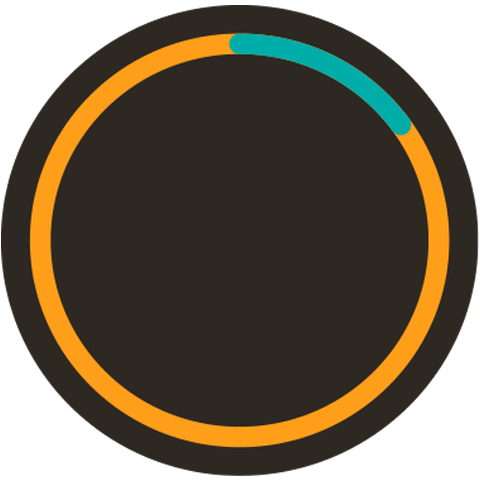

Halfords share of the Motoring market

Car parts, accessories, technology and consumables

Car servicing and aftercare

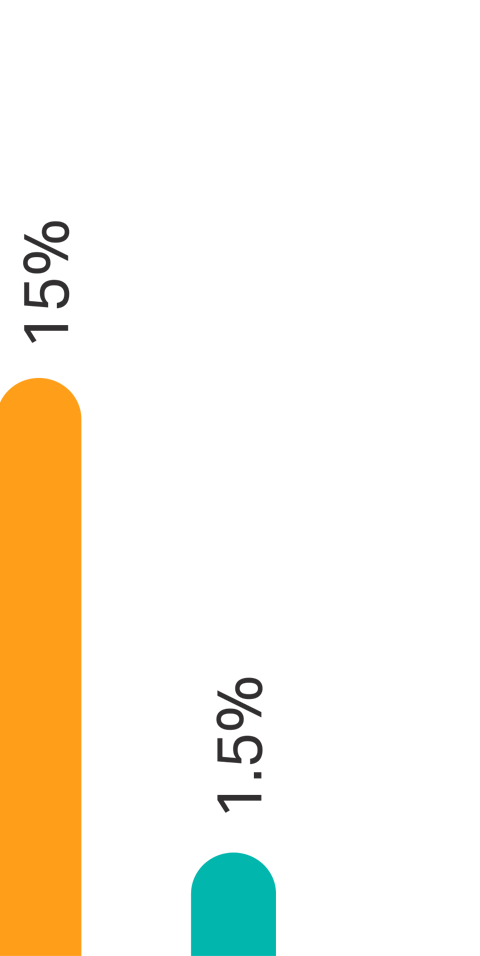

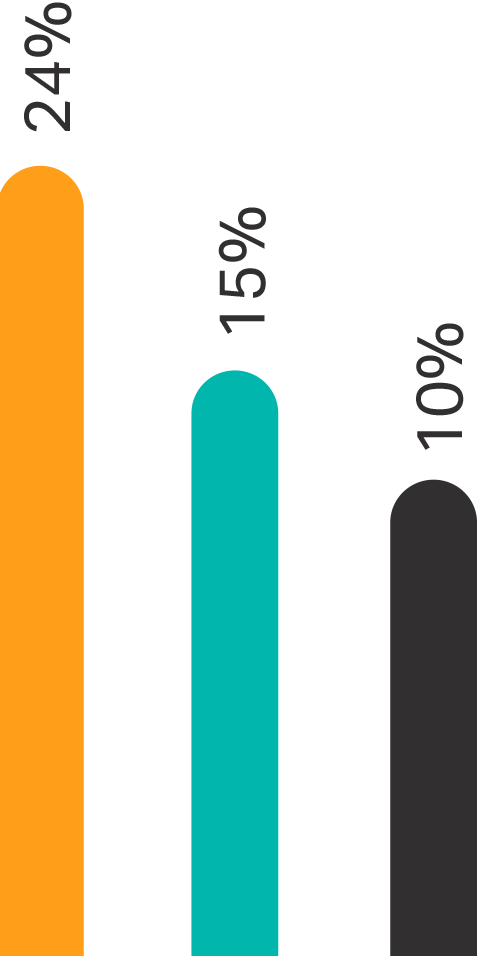

Halfords share of the Cycling market

Bikes

PAC's

Repair

Within Motoring, the Halfords Group operates in two segments:

- Car parts, accessories, consumables and technology, with a total market worth up to an estimated £7bn. This element of the Motoring market has grown by around 3% per annum in the last few years. Halfords Retail competes in a portion of this market worth circa £3bn, holding around a 15% market share.

- Car servicing and aftercare, with a total market worth around £9bn. This element of the market has grown by around 2% per annum in the last few years and is where Autocentres competes, holding around 1.5% share of a highly fragmented market.

Going forward we anticipate the Motoring market to continue to grow at an average rate of 2-3% per annum over the medium-term. The number of cars on the road is rising and the mileage being driven is increasing. The number of new car registrations in 2015 was the highest on record. The average age of cars in the UK is steady at around 7.5 years.

Cars are also becoming more complex, with greater variety of models and enhanced technology making it more difficult or even impossible for people to "Do it Yourself". For example, replacing a stop-start battery requires connection with the on-board computer — something that Halfords stores and colleagues are equipped to do, but is not possible for an individual. This complexity, combined with a change in needs from increasingly time-poor consumers, is driving the "Do It For Me" trend.

Our product ranges continue to evolve in line with market requirements and advances in automotive technology. For example, stop-start batteries are becoming increasingly prevalent and we have the right equipment and fully-trained colleagues to be able to cater to this demand, both in our Retail stores and our Autocentres.

We continue to see good growth in some subsections of our in-car technology offering. In-car cameras ("dash cams") continue to be very popular and we are uniquely placed to offer a comprehensive advice and fitting service for these products. Multimedia, connectivity and streaming technology continue to grow as customers look for ways to bring their in-car environment more technologically up-to-date.

The sat nav market continues to decline, but this is becoming an increasingly smaller and less important part of our business. Key products such as child car seats continue to be important for customers and are providing growth.

Likewise, the services we offer alongside our products continue to evolve, as evidenced by the continued success of our "3Bs" (bulbs, blades, batteries) fitting service. In FY16 in the Retail stores we sold nearly 9 million 3B products and fitted 38% of these on demand.

The growth in new drivers, cars, miles driven and car complexity is also an opportunity for our Autocentres business to attract and retain new customers. Trust, value, convenience and the attitude of our colleagues are also key to doing this as well as retaining our long-standing Halfords customers.

The Cycling Market

The Cycling market is not particularly well documented, with data difficult to come by, which is reflective of the fragmented nature of the operators within it. As such we conduct our own extensive, bespoke customer and market research, some of which we have included below.

The Cycling market had been growing at a compound annual growth rate of around 6–8% over the three years prior to 2015.

The market for bikes is estimated to be around £800m and for parts, accessories and clothing ("PACs") around £750m. In recent years we have gained share in bikes, now standing at around 24% of the market. Our share of the PACs market has remained steady at around 15%. In cycle repair, a market of around £100m, our investments in equipment and people have resulted in strong growth, and we believe we have been continuing to take share over the past 12 months.

Our Cycling sales were particularly strong over 2013 and 2014 due to a combination of factors:

- The economic conditions were favourable with true disposable income recovering to drive big ticket purchases.

- There was plenty of positive media coverage driving awareness around cycling — the fantastic achievements of Team GB at the London Olympics, the Tour de France starting in Yorkshire and more amateur cycling and triathlon events.

- The Government has continued to invest in infrastructure and safety, particularly in London.

- Whilst the Cycle to Work initiative has been in place for some time now, awareness and participation grew significantly over those years.

- Finally, we saw consistently warm and sunny summers in 2013 and 2014.

New cyclists look for entry level bicycles around the £200–300 mark and our fantastic Apollo and Carrera ranges meant Halfords was better positioned than most to benefit from this.

Looking forward we have confidence in the long-term growth potential of the cycling market, based on our understanding of the customer and macro factors, both economic and social. We anticipate that the Cycling market will grow by 3-5% per annum on average.

Our research has identified cyclists by how they use their bike and how often they use it, and although there are many subtleties in the segmentation, we broadly see three types of customers:

- Those who use their bike for leisure; cycling with family and friends for light exercise

- Those who commute

- Those who are cycling for fitness and potentially entering competitions and cycling with clubs.

The fitness cyclists are not the only set who cycle frequently and are engaged or enthusiastic about cycling. Our research has revealed that many of the leisure cyclists are cycling just as often and are just as engaged.

Reflecting on the different customers, we know that we over-index in our share of cyclists riding for leisure purposes and conversely under-index with those who cycle for fitness or cycle in clubs. We know these groups behave and therefore spend differently, so we have a dual offering in cycling with Halfords and now Cycle Republic.

The total pool of people now cycling has increased and they are cycling more often and more miles than previously. We have confidence that those who are currently cycling will continue to do so. Our research shows that these more frequent cyclists replace their bikes more often; a large proportion of frequent cyclists plan to replace their bikes within the next year. Fitness cyclists are more likely to increase their bike spend the most, sometimes doubling it. They are also the group that buy more PACs.

Our research also looked at those not cycling today and we were very encouraged by the proportion of them that intended to buy a bike in the near term.

In addition to understanding the customer we've also looked at future market drivers. We know that participation in the UK is still low and there is large scope for new entrants as well as increased spend from existing cyclists. Also, female participation is particularly low, but growing. This presents an opportunity for us because we know that an increase in female cyclists will also drive an increase in families and children taking up cycling. Furthermore, there is significant government support in London and in many other cities. For example, there are now four cycle super-highways in London and five more to come.

Looking specifically at recent market performance, our analysis suggests that the market declined in the last 12 months, due to the reasons explained in the operational review. This decline was principally attributed to the summer of 2015. Since then we have observed a gradual stabilising of market conditions, notwithstanding that it may take some time to return to consistent growth and the weather continues to have an impact on the timing of customer purchase.

However we remain confident in the long-term growth prospects of the cycling market. Participation in the UK is still low and there is large scope for new cyclists as well as increased spend from existing cyclists. This is supported by significant government support in London and in many other cities, as well as consumer trends towards healthy activities.

A 'win-win' collaboration

We understand the fear many adults have of getting back on a bike after years out of the saddle so, to help, we partnered with British Cycling's Breeze network. British Cycling's Breeze network is the largest programme in Britain, designed specifically to get more women cycling. Led by women for women, Breeze is underpinned by an amazing network of volunteers — Breeze Champions — who organise local rides catering to all levels, from grassroots up.

The partnership is a 'win-win' collaboration, increasing the profile of British Cycling's Breeze network and supporting our appetite to grow women's cycling. In addition to promoting the network to customers on our website and through emails, in FY16 we piloted bike maintenance workshops in partnership with Breeze, with over 2,500 women attending and 97% saying they'd recommend the workshop to others. Later in the summer our cycle mechanic crew supported cycle events organised by Breeze, with a team of Halfords colleagues also taking part. The partnership has also provided the opportunity for colleagues to become Breeze champions too.