Annual Remuneration Report

"Our remuneration philosophy is aimed at providing Executive Directors with incentive opportunities strongly aligned to growth, profitability and shareholder returns."

The Committee

During the period, the Remuneration Committee (the "Committee") consisted of Claudia Arney (Chair), Dennis Millard, David Adams and Helen Jones.

All members are considered to be independent for the purposes of the UK Corporate Governance Code. The Company Secretary acts as secretary to the Committee.

The Board has delegated responsibility to the Committee for ensuring that a policy exists for the remuneration of the CEO, the Chairman, other Executive Directors and members of executive management. The Committee has designed a policy that provides Executive Directors with the appropriate incentives to enhance the Group's performance and to reward them for their personal contribution to the business. The Committee's other activities include:

- recommending to the Board the total individual remuneration package of Executive Directors and members of executive management;

- recommending the design of Company share incentive plans to the Board, approving any awards to Executive Directors and other executive managers under those plans and defining any performance conditions attached to those awards;

- determining the Chairman's fee, following a recommendation from the CEO; and

- maintaining an active dialogue with institutional investors and shareholder representatives.

The Committee's full Terms of Reference are set out on the Company's website.

Read more at

www.halfordscompany.com/investors/governance/our-committees/remuneration-committee

The Committee met on eight occasions during the period; attendance details are shown in the table in the Corporate Governance Report. Details of advisors to the Committee can be found below.

Summary of Committee Activity during FY16

In this period, the Committee has:

- discussed and approved both financial and strategic annual bonus metrics and targets;

- discussed and reviewed Directors' salaries;

- set parameters for the potential package available for the new CFO;

- discussed and reviewed attainment against the performance conditions for the Performance Share Plan and Company Share Option Scheme due to vest during the period;

- approved grants under the Performance Share Plan, Company Share Option Scheme (to senior managers below Board) and Sharesave Scheme;

- reviewed and approved the termination arrangements in relation to the outgoing CFO and Company Secretary;

- considered and approved the Service Agreements and letters of appointment for the new CFO;

- reviewed its choice of appointed remuneration advisors; and

- reviewed the Terms of Reference of the Committee.

Structure and content of the Remuneration Report

This Remuneration Report has been prepared in accordance with the provisions of the Companies Act 2006 and Schedule 8 of the Large and Medium-sized Companies and Group (Accounts and Reports)(Amendment) Regulations 2013. This Report meets the requirements of the Listing Rules and the Disclosure and Transparency Rules.

The information set out below represents auditable disclosures referred to in the Auditor's Report, as specified by the UK Listing Authority and the Regulations.

Advisors

During the year, the Committee has been supported by Jonathan Crookall, People Director and Justin Richards, Company Secretary until his departure in December 2015, and by his replacement Tim O'Gorman from January 2016. The CEO and CFO also attend Committee meetings on occasion, at the request of the Committee; they are never present when their own remuneration is discussed. The Committee also engaged with Deloitte LLP, which advised on performance measures for the PSP, remuneration reporting and other remuneration matters. Fees paid to Deloitte for this advice were £6,250, their fees are charged on a time and materials basis. Deloitte has also provided advice to management, to enable their support of the Committee, primarily in relation to remuneration reporting.

Deloitte is a founding member of the Remuneration Consultants Group and adheres to the Remuneration Consultants Group Code of Conduct when dealing with the Committee. We consider Deloitte's advice to be independent and impartial. We are also satisfied that the Deloitte Engagement Partner and team, who provided remuneration advice to the Committee, do not have connections with the Company that might impair their independence. The Committee considered the potential for conflicts of interest and judged that there were appropriate safeguards against such conflicts.

Willis Towers Watson also provided the Committee with executive salary benchmark data. Willis Towers Watson is also a signatory of the Remuneration Consultants Code of Conduct. Fees paid to Willis Towers Watson for this advice were £3,500. Willis Towers Watson also provides insurance broking services to the Group.

Shareholder Dialogue

The voting outcome from the 2015 Annual General Meeting reflected very strong individual and institutional shareholder support. We continue to be mindful of the concerns of our shareholders and other stakeholders and welcome shareholder feedback on any issue related to executive remuneration. In the event of a substantial vote against a resolution in relation to Directors' remuneration, we would seek to understand the reasons for any such vote, determine appropriate actions and detail any such actions in response to it in the Directors' Remuneration Report.

The following table sets out the votes cast at the 2015 AGM in respect of the previous Remuneration Report.

Votes in relation to the Annual Report on Remuneration

| % of votes

For | % of votes

Against |

|---|

| FY15 Directors' Remuneration Report (2015 AGM)* | 99.02% | 0.87% |

* 0.11% votes were withheld in relation to this resolution.

How was the Remuneration Policy Implemented in 2015/16 – Executive Directors

Single remuneration figure (audited)

| Base

Salary | Bonus | Benefits | Pension | PSP | Other | Total 'Single

Figure' |

|---|

| 2015/2016 | | | | | | | |

| Jill McDonald1 | 450,513 | 159,390 | 24,779 | 69,500 | — | 147,279 2 | 851,461 |

| Jonny Mason3 | 166,026 | 38,690 | 8,372 | 22,278 | — | 71,777 4 | 307,143 |

| Matt Davies5 | 43,138 | n/a | 2,736 | 8,458 | n/a | n/a | 54,332 |

| Andrew Findlay6 | 167,025 | n/a | 8,410 | 24,900 | n/a | n/a | 200,335 |

| Totals | 826,702 | 198,080 | 44,297 | 125,136 | — | 219,056 | 1,413,271 |

| 2014/15 | | | | | | | |

| Jill McDonald | n/a | n/a | n/a | n/a | n/a | n/a | n/a |

| Jonny Mason | n/a | n/a | n/a | n/a | n/a | n/a | n/a |

| Matt Davies | 512,575 | —7 | 31,102 | 101,500 | n/a8 | n/a | 645,177 |

| Andrew Findlay | 328,250 | —7 | 15,609 | 49,230 | 143,4388 | n/a | 536,527 |

| Totals | 840,825 | — | 46,711 | 150,730 | 143,4388 | — | 1,181,704 |

- Jill was appointed on 11 May 2015

- On 13 February 2016 Jill McDonald received a gift of 38,973 ordinary shares as announced on 15 February 2016, made as compensation for Jill's forfeited entitlement to long term incentives and share options with her previous employer. Further tranches will be delivered annually until 2019.

- Jonny Mason was appointed on 12 October 2015

- In accordance with the announcement on 2 July 2015 Jonny Mason received a payment in March 2016 to replace his pro-rated bonus from his previous employer equivalent to the amount he would have received based on performance

- Matt Davies resigned on 30 April 2015

- Andrew Findlay resigned on 1 October 2015

- Matt Davies and Andrew Findlay tendered their resignations prior to the payment of the FY15 bonus and, accordingly, were not eligible to receive any bonus in respect of the period

- Shares were awarded in August 2012 under the Performance Share Plan based on performance in the period April 2012 to March 2015. In May 2015 the performance conditions for these shares were measured and the Committee determined that 15% of awards would vest. Matt Davies did not receive a PSP award in 2012 as this was prior to his joining the Company.

Salary

In keeping with its usual cycle of reviewing Company-wide salaries in October, the Committee considered an executive pay report compiled for it by Willis Towers Watson and accordingly decided to increase the CEO salary by 2%, mirroring the increase generally awarded to colleagues in the Support Centre. The CFO did not join until 12 October 2015 and therefore his salary was not eligible for review. Salaries will next be reviewed from 1 October 2016.

2015/16 Annual Bonus

Annual bonuses for FY16 for Executive Directors were based 80% on Group PBT and 20% on the delivery of key strategic initiatives crucial to the delivery of the Company's strategy.

Annual bonuses reported in the table on above and payable in June 2016 for the FY16 financial period were calculated as follows:

| Measure | Bonus

Opportunity

(% of total

award) | Performance | Performance

delivered | Bonus

awarded

(% of total

award) |

|---|

| Threshold | Target | Stretch |

|---|

| PBT | 80% | 94% of budget | 100% of budget | 106% of budget | PBT for the year was in excess of 94% of budget and therefore 15% of the annual bonus is payable | 12% |

| Key Strategic Initiatives |

| Net promoter score | As measured by the talkback mechanism in stores – increasing the average score over the final three months of the year | Achieved | 3.3% |

| Engagement index | Increasing the year on year engagement index based on the annual survey | Not achieved | 0% |

| Value added sales | Increasing the total incremental sales in the financial year of 3Bs fitting, other auto fitting, cycle repair, Sat Nav attachment and cycle accessories | Partially achieved | 1.9% |

| Store colleague turnover | The average total number of leavers (retail colleagues) | Partially achieved | 2.9% |

| 50:39 store delivery | Successful roll out of programme to defined standard | Achieved | 3.3% |

| Cycle Republic roll out | Performance of new stores | Not achieved | 0% |

| Total Bonus | | | | | | 23.5% |

The annual bonus outturn was reviewed in the context of the performance of the underlying business during the year and delivery against strategy. In that context, we assessed the level of bonus to be appropriate however, due to the resignations of Matt Davies and Andrew Findlay prior to the payment of bonus, each ceased to be eligible and, therefore, did not receive a bonus in respect of the period.

Bonus payments for Jill McDonald and Jonny Mason were pro-rated based on their respective start dates.

| PBT | Strategic Measures | Total |

|---|

| Jill McDonald | £81,535 | £77,855 | £159,390 |

| Jonny Mason | £19,792 | £18,898 | £38,690 |

Jill's bonus was paid two-thirds in cash with one-third being deferred into shares for a period of three years. Jonny's bonus was paid in cash.

We are committed to providing the greatest possible transparency in relation to retrospective achievement against the objectives that form part of the bonus measures. Clearly, some of those measures are commercially sensitive and to disclose them could reveal information about our business planning and budgeting to competitors, which could be damaging to our business interests and, therefore, also to shareholders. Of the FY16 metrics against which bonus outturn has been assessed, we are able to disclose the following:

| Measure | Threshold | Maximum | FY16

performance |

|---|

| Engagement index | 80% | 82% | 78% |

| Store colleagues turnover | 44% | 40% | 41% |

| Measure | FY16 performance against

FY15 outturn |

|---|

| Net promoter score | +6%pts |

| Value added sales | +9.4% |

2013 Performance Share Plan Award

Awards granted in 2013 under the PSP were subject to the following performance conditions:

| | Group Revenue Growth – CAGR

(25% of the award) | Group EBITDA Growth

(75% of the award) |

|---|

Award "Multiplier"

(up to 1.5× initial award)

i.e. 225% of salary. | 1.5× initial award vesting | 8% or more | 6.5% or more |

| Straight-line vesting | Between 4.75% and 8% | Between 3.25% and 6.5% |

Core Award

(150% of salary) | 100% vesting | 4.75% | 3.25% |

| Straight-line vesting | Between 4.0% and 4.75% | Between 2.5% and 3.25% |

| 30% vesting | 4.0% | 2.5% |

| 0% vesting | Below 4.0% | Below 2.5% |

The performance conditions for 2013 awards are based on Group revenue performance and Group EBITDA growth. The CAGR and EBITDA performance are assessed on an independent basis. However, to ensure that the PSP continues to support sustainable performance, the performance levels are set on a stepped basis, where vesting on the revenue measure can only be one step above the EBITDA measure.

The following table shows the history of PSP award vesting over the last 5 five years.

| FY12 | FY13 | FY14 | FY15 | FY16 |

|---|

| PSP vestings (% of maximum) | 0% | 0% | 0% | 15% | 102.5% |

Benefits

Benefits include payments made in relation to life assurance, private health insurance and the provision of a fully expensed company car or equivalent cash allowance and fuel card.

Pension

Pension payments represent contributions made either to defined contribution pension schemes or as a cash allowance. The CEO and CFO both received a contribution of 15% of base salary.

Share Awards Granted During the Year (Audited)

Performance Share Plan

During the period we approved awards to the Executive Directors under the Performance Share Plan as follows:

| Date

of award | Type

of award | Number

of shares* | Maximum face

value of award

(1.5x the number

of awards

granted)** | Threshold

vesting (%

of target award) | Performance

period |

|---|

| Jill McDonald | 14 August 2015 | Nil cost option

(0p exercise price) | 140,800 | £1,126,752 | 30% | 4 April 2015 to

30 March 2018 |

| Jonny Mason | 12 November 2015 | | 122,130 | £723,620 | | |

* These awards were based on 150% of salary

** Based on the mid-market price on the date of the awards of £5.335 on 14 August 2015 and £3.95 on 12 November 2015

CEO Share Award

The Board agreed that upon joining the Company, Jill McDonald would be given an award of shares to compensate her for award made by her previous employer that lapsed on resignation. The value of these shares was £529,819. These would be delivered in tranches in each of the next four years.

Performance Conditions

Awards granted in 2015 are subject to the following performance conditions:

| | Group Revenue

Growth – CAGR

(25% of the award) | Group EBITDA

Growth

(75% of the award) |

|---|

Award "Multiplier"

(up to 1.5× initial award)

i.e. 225% of salary. | 1.5× initial award vesting | 6.5% or more | 9.0% or more |

| Straight-line vesting | Between 52.% and 6.5% | Between 7.1% and 9.0% |

Core Award

(150% of salary) | 100% vesting | 5.2% | 7.1% |

| Straight-line vesting | Between 4.0% and 5.2% | Between 4.5% and 7.1% |

| 30% vesting | 4.0% | 4.5% |

| 0% vesting | Below 4.0% | Below 4.5% |

In addition to achieving these targets, the vesting of awards will be subject to meeting an underpin of net debt to EBITDA ratio no greater than 1.5x throughout the three-year performance period. This will ensure that net debt remains at appropriate levels and management is not incentivised to increase net debt levels to meet targets; the focus is to maximise the return on cash investments. The Core Award shares that vest will become exercisable in August 2018. To the extent that awards vest in line with the performance multiplier outlined above, these shares will only become exercisable in August 2020, following a retention period of two years. Please note, the 2015 Annual Report and Accounts had a typographical error, the correct figures as agreed by the Remuneration Committee on 3 June 2015 are shown in the table above.

Outstanding Share Awards (Audited)

Performance Share Plan

The following summarises outstanding awards under the PSP:

| Award

date | Mid-

market

price on

date of

awards

£ | Awards

held

3 April

2015 | Awarded during

the

period | Dividend

Reinvestment1 | Forfeited

during

the

period | Lapsed

during

the

period | Exercised

during

the

year | Awards

held

1 April

2016 | Performance

period

3 years

to |

|---|

| Jill McDonald2 | 14 August 2015 | 5.34 | — | 140,800 | 2,116 | — | — | — | 142,916 | 30 March

2018 |

| Jonny Mason3 | 12 November 2015 | 3.95 | — | 122,130 | 1,836 | — | — | — | 123,966 | 30 March

2018 |

| Matt Davies4 | 7 August 2013 | 3.74 | 209,116 | — | — | 209,116 | — | — | — | n/a |

| 11 August 2014 | 4.79 | 163,596 | — | — | 163,596 | — | — | — | n/a |

| Andrew Findlay5 | 7 August 2013 | 3.74 | 117,314 | — | 2,489 | 119,803 | — | — | — | n/a |

| 11 August 2014 | 4.79 | 104,766 | — | 2,223 | 106,989 | — | — | — | n/a |

- Interim and final dividends have been reinvested in shares at prices between £3.77 and £5.19

- Jill McDonald was appointed on 11 May 2015

- Jonny Mason was appointed on 12 October 2015

- Matt Davies resigned on 30 April 2015 and his outstanding PSP awards lapsed at this date in accordance with the scheme rules

- Andrew Findlay resigned on 1 October 2015 and his outstanding PSP awards lapsed at this date in accordance with the scheme rules

The performance conditions for 2013 awards onwards have performance conditions based on Group revenue performance and Group EBITDA growth.

Deferred Bonus Plan

Jill McDonald will be eligible for the Deferred Bonus Plan.

CEO Pay Compared to Performance

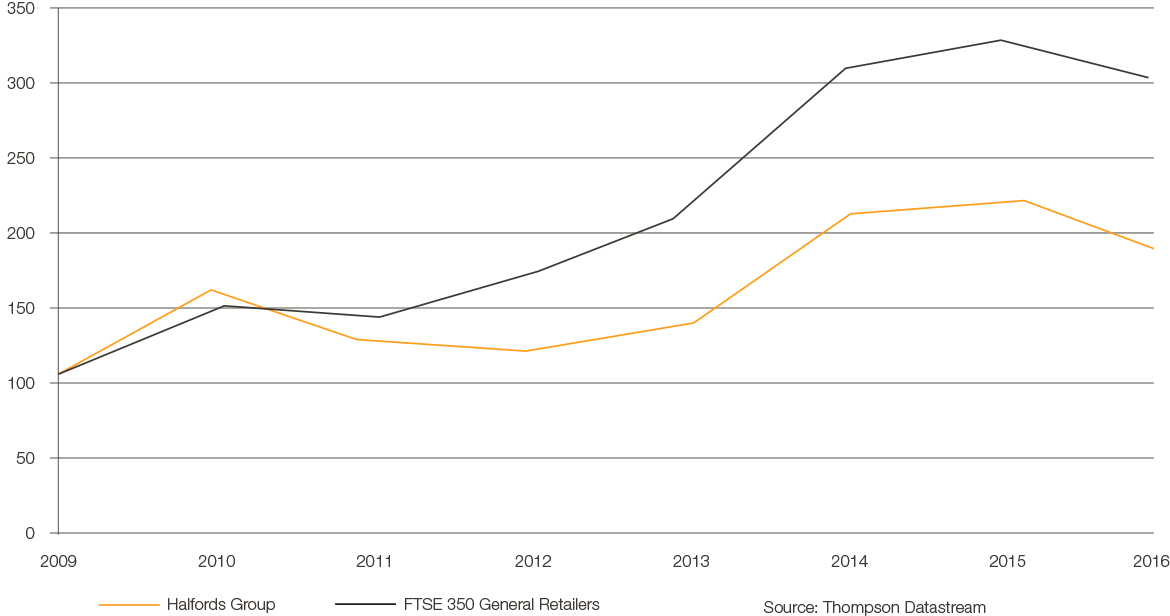

The following graph shows the TSR performance of the Company since April 2009, against the FTSE 350 General Retailers (which was chosen because it represents a broad equity market index of which the Company is a constituent).

The following table summarises the CEO single figure for the past five years and outlines the proportion of annual bonus paid as a percentage of the maximum opportunity and the proportion of PSP awards vesting as a percentage of the maximum opportunity. The annual bonus is shown based on the year to which performance related and the PSP is shown for the last year of the performance period.

| | 2009/10 | 2010/11 | 2011/12 | 2012/13 | 2013/14 | 2014/15 | 2015/16 |

|---|

CEO single figure

(£000) | Jill McDonald1 | — | — | — | — | — | — | 851 |

| Matt Davies2 | — | — | — | 499 | 1,372 | 645 | 54 |

| David Wild3 | 1,134 | 531 | 617 | 198 | — | — | — |

| Annual bonus (% of maximum) | Jill McDonald | — | — | — | — | — | — | 23.5% |

| Matt Davies | — | — | — | 50% | 97.5% | —4 | —4 |

| David Wild | 80% | — | 0% | — | — | — | — |

PSP vesting (% of

maximum) | Jill McDonald | — | — | — | — | — | — | —1 |

| Matt Davies | — | — | — | — | — | — | — |

| David Wild | — | — | 99% | — | — | — | — |

- Jill McDonald was appointed on 11 May 2015

- Matt Davies was appointed on 4 October 2012 and resigned as CEO on 30 April 2015. Matt did not receive PSP awards in 2012, as these were before he was appointed

- David Wild resigned as CEO on 19 July 2012

- Matt Davies tendered his resignation prior to the payment of the FY15 bonus and, accordingly was not eligible to receive any bonus in respect of the period

Shareholding Guidelines (Audited)

The Committee believes that it is important that Executive Directors' interests are aligned with those of our shareholders to incentivise them to deliver the corporate strategy, thus creating value for all shareholders. Executive Directors are encouraged to acquire and retain shares with a value equal to 100% of their annual base salary. Executive Directors have a five-year period to build this shareholding following their appointment.

| Jill McDonald | Jonny Mason |

|---|

| Shareholding requirement | 100% | 100% |

| Current shareholding | 20,618 | 75,000 |

| Current value (based on share price on 1 April 2016) | £80,740 | £293,700 |

| Current % of salary | 16% | 84% |

| Date by which guideline should be met | 11 May 2020 | 12 October 2020 |

These figures include those of their spouse or civil partner and infant children, or stepchildren, as required by Section 822 of the Companies Act 2006. There was no change in these beneficial interests between 1 April 2016 and 1 June 2016.

Outside Appointments

Halfords recognises that its Executive Directors may be invited to become non-executive directors of other companies. Such non-executive duties can broaden experience and knowledge which can benefit Halfords. Subject to approval by the Board, Executive Directors are allowed to accept non-executive appointments and retain the fees received, provided that these appointments are not likely to lead to conflicts of interest. Jill McDonald received fees of £72,600 as a non-executive director of Inter Continental Hotels Group plc in the period.

Leaving Arrangements

Matt Davies left on 30 April 2015, Andrew Findlay left on 1 October 2015. Neither received a termination payment and any outstanding incentives were forfeited.

Loss of Office Payments (Audited)

No loss of office payment was made to a Director during the year.

Payments to Former Directors (Audited)

Matt Davies resigned on 30 April 2015 and in accordance with the Deferred Bonus Plan rules exercised his awards of 72,332 shares on 15 June 2015.

How was the Remuneration Policy Implemented in 2015/2016 – Non-Executive Directors

Non-Executive Director single figure comparison (audited)

| Director | Role | Board

Fees | Senior

Independent

Director | Committee

Chairman

Fees | Total

'Single

Figure'

2016 | Total

'Single

Figure'

2015 |

|---|

| Dennis Millard | Chairman | 176,000 | | | 176,000 | 174,000 |

| David Adams | Senior Independent Director & Audit Committee Chairman | 48,000 | 15,000 | 5,000 | 68,000 | 68,000 |

| Claudia Arney | Remuneration Committee Chairman | 48,000 | | 5,000 | 53,000 | 53,000 |

| Helen Jones | CSR Committee Chairman | 48,000 | | | 48,000 | 48,000 |

| Totals | | 320,000 | 15,000 | 10,000 | 345,000 | 343,000 |

Non-Executive Director Shareholding

| Director | 2016 | 2015 |

|---|

| Dennis Millard | 60,000 | 50,000 |

| David Adams | 6,780 | 6,544 |

| Claudia Arney | 21,052 | 21,052 |

| Helen Jones | 3,000 | 3,000 |

These figures include those of their spouses, civil partners and infant children, or stepchildren, as required by Section 822 of the Companies Act 2006. There was no change in these beneficial interests between 1 April 2016 and 6 June 2016.

Non-Executive Directors do not have a shareholding guideline but they are encouraged to buy shares in the Company.

How Remuneration Policy will be Implemented for 2016/17 — Executive Directors

Salary

Base salaries were reviewed with effect from 1 October 2015 and increases were made as per the details in the Remuneration Policy Summary . Current salaries for the Executive Directors are as follows:

Salaries will next be reviewed with effect from 1 October 2016.

Annual Bonus

The annual bonus opportunity for 2016/17 will be as follows:

| CEO | - Maximum opportunity of 150% of base salary

- 2/3 paid in cash

- 1/3 paid in Halfords shares deferred for three years

|

| CFO | - Maximum opportunity of 150% of base salary

- 2/3 paid in cash

- 1/3 paid in Halfords shares deferred for three years

|

The annual bonus will continue to be based 80% on Profit Before Tax ('PBT') performance and 20% based on performance against strategic objectives. PBT targets range from 90% of budget, where payment is 15% to 110% of budget for maximum payment. The Committee reviews the goals included in the strategic objectives portion of the bonus to ensure that they remain appropriate. These objectives include metrics in relation to customer service and colleague engagement.

In determining whether any bonuses are payable, the Committee retains the discretionary authority to increase or decrease the bonus to ensure that the level of bonus paid is appropriate in the context of performance. Bonus targets are considered by the Board to be commercially sensitive as they could reveal information about Halfords' business plan and budgeting process to competitors which could be damaging to Halfords' business interests and therefore to shareholders.

Performance Share Plan

For the Executive Directors we intend to continue granting awards under the Performance Share Plan of 150% of base salary. If exceptional performance is achieved up to 1.5x the core award can be earned ('performance multiplier'). The vesting of awards will be subject to meeting the following performance conditions:

| | Group Revenue

Growth – CAGR

(25% of the award) | Group EBITDA

Growth

(75% of the award) |

|---|

Award "Multiplier"

(up to 1.5× initial award)

i.e. 225% of salary | 1.5× initial award vesting | 6.7% or more | 7.5% or more |

| Straight-line vesting | Between 5.5% and 6.7% | Between 6.0% and 7.5% |

Core Award

(150% of salary) | 100% vesting | 5.5% | 6.0% |

| Straight-line vesting | Between 4.0% and 5.5% | Between 4.0% and 6.0% |

| 30% vesting | 4.0% | 4.0% |

| 0% vesting | Below 4.0% | Below 4.0% |

In addition to achieving these targets, the vesting of awards will be subject to meeting an underpin of net debt to EBITDA ratio no greater than 1.5× throughout the three-year performance period. This will ensure that net debt remains at appropriate levels and management is not incentivised to increase net debt levels to meet targets; the focus is to maximise the return on cash investments. The Core Award shares that vest will become exercisable in May 2019. To the extent that awards vest in line with the performance multiplier outlined above, these shares will only become exercisable in May 2021, following a retention period of two years.

While committed to the use of equity-based performance-related remuneration as a means of aligning Executive Directors' interests with those of shareholders, we are aware of shareholders' concerns on dilution through the issue of new shares to satisfy such awards. Therefore, when reviewing remuneration arrangements, we take into account the effects such arrangements may have on dilution. Halfords intends to comply with the Investment Association guidelines relating to the issue of new shares for equity incentive plans.

How Remuneration Policy will be Implemented for 2016/17 — Non-Executive Directors

Fees

The fees of Non-Executive Directors are normally reviewed every two years to ensure that they are in line with market benchmarks. Any changes to these fees will be approved by the Board as a whole following a recommendation from the Chief Executive. The base fee for Non-Executive Directors was increased by 4% as from 1 April 2016, this was the first increase in these fees since April 2013. Current fees for Non-Executive Directors are as follows:

| 2017 | 2016 |

|---|

| Chairman | £185,000 | £176,000 |

| Base fee | £50,000 | £48,000 |

| Additional fees | | |

| Senior Independent Director | £10,000 | £15,000 |

| Committee Chairman (Audit and Remuneration) | £10,000 | £5,000 |

| Committee Chairman (CSR) | £5,000 | - |

Spend on Pay

The Committee is aware of the importance of pay across the Group in delivering the Group's strategy and of shareholders' views on executive remuneration.

Change in Remuneration of Chief Executive Compared to Group Employees

The table below sets out the increase in total remuneration of the Chief Executive and that of all colleagues.

| % change in base salary

FY15 to FY16 | % change in bonus earned

FY15 to FY16 | % change in benefits

FY15 to FY16 |

|---|

| Chief Executive | —11 | —2 | No change |

| All colleagues | 2.57 | -52 | No change |

The increase generally awarded to all colleagues was 2% with an additional 1% merit pot

- Jill McDonald was recruited on a salary of £500,000 which was 3% lower than the previous CEO's salary of £517,650. On 1 October 2015 Jill received a 2% salary increase taking her salary to £510,000 resulting in her salary being 1% lower than the CEO's salary for the previous period

- Jill McDonald will receive a pro rata bonus for FY16 as she joined during the period on 11 May 2015. No bonus was payable to Matt Davies, previous CEO for FY15 as he left the business on 30 April 2015

Relative Importance of Pay

The Committee is also aware of shareholders' views on remuneration and its relationship to other cash disbursements. The following table shows the relationship between the Company's financial performance, payments made to shareholders, payments made to tax authorities and expenditure on payroll.

| 2016 | 2015 |

|---|

| EBITDA | £114.6m | £109.9m1 |

| PBT (underlying)1 | £81.5m | £81.1m1 |

| Returned to shareholders: | | |

| Dividend | £32.4m | £28.4m |

| | |

| Payments to employees: | | |

| Wages and salaries | £183.3m | £183.7m |

| Including directors2 | £1.4m | £1.2m |

- Based on the 52 week period.

- Based on the single figure calculation, not all of which is included within wages and salary costs.